top of page

Tax Cuts 2021

As you may or may not be aware, in October 2020 the Government brought forward the tax cuts that had originally been scheduled for July...

Amanda Amey

May 5, 20212 min read

Are you Running Out of Time?

Even though the end of the financial year is only the 30th June there is a mountain of things that you can do to prepare for a good tax...

Amanda Amey

Mar 25, 20212 min read

What do the job dot's mean in SM8 (Service M8 for Job Scheduling)

Why does the red dot mean so much?

If it hasn't been completed, queued or rescheduled to another day, where is it?

Amanda Amey

Feb 17, 20212 min read

Are you getting all your Tax Concessions?

If you are in business then chances are, you are eligible for a range of tax concessions. Whilst concessions are based on your...

Amanda Amey

Feb 16, 20214 min read

Tips for claiming GST credits

Just having an ABN does not mean that you are necessarily GST registered. Please check with your Tax Agent or Bas Agent to check if your...

Amanda Amey

Feb 10, 20212 min read

Batch payments can save you time!

Batch payments enable you to download an ABA file from Xero (after processing the pay run) and then upload it straight to your online...

Amanda Amey

Feb 9, 20211 min read

How to do a Quick Pay Run in Xero

Why do you have to do the Pay run? To "run a pay run", really just means that you are processing the payroll on your accounting software....

Amanda Amey

Feb 9, 20212 min read

How Multi Photo and Audio Tagging works in Service M8

The new improved photo engine allows you to take multiple photos faster than ever before, review the photos instantly and add voice...

Amanda Amey

Jan 14, 20211 min read

Are you eligible for the Apprentice Subsidy?

The Australian Government has announced the Boosting Apprenticeship Commencements wage subsidy to support employers and Group Training...

Amanda Amey

Jan 14, 20211 min read

Are you eligible for the Job Maker Credits?

Whilst the Job Maker scheme is designed as an incentive for employers to take on additional young job seekers and is a payment made to...

Amanda Amey

Jan 13, 20212 min read

Working from home short cut method has been extended

The ATO's temporary shortcut method for calculating working from home related expenses on your tax return was initially only valid until...

Amanda Amey

Jan 13, 20212 min read

Are you processing Annual leave correctly?

If not, this can be a costly mistake. IN XERO leave taken by employees must be processed the correct way or else the leave you pay them,...

Amanda Amey

Dec 4, 20202 min read

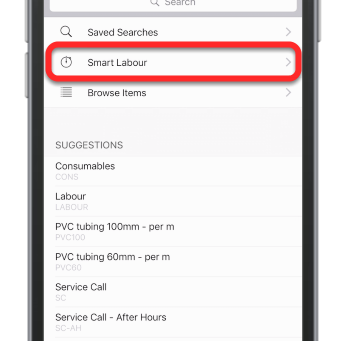

Smart Labour on Service M8

One of the many self employed challenges is ensuring that you are charging your client correctly for the time spent on the job.

Amanda Amey

Nov 25, 20201 min read

More on the JobMaker Subsidy

Apprentice Subsidy COVID-10 has seen the Australian Government announce two important programs, recently announced in the 2020 Federal...

Amanda Amey

Nov 19, 20203 min read

Jobkeeper 2.0

JobKeeper Stage 2 begins from 28 September 2020. The basics are similar to Jobkeeper 1, but there are changes. . Testing will be based...

Amanda Amey

Sep 28, 20201 min read

Has Your Business paid a contractor this year? TPAR reporting is due !

If you are running a business that provides any of the following services and you pay contractors or subcontractors for these services...

Amanda Amey

Aug 19, 20201 min read

Have you received a Government Grant?

If your business has received a grant or payment from the Australian Government or a state or territory government, you may need to...

Amanda Amey

Aug 19, 20201 min read

Job Keeper Extension

As the Federal Government announces the extension of the JobKeeper payment, both employers and employees are all grappling to try to...

Amanda Amey

Jul 22, 20202 min read

Job Keeper and Cashflow Boost

What's assessable and whats not? The Job Keeper payment is assessable income, which means that you may have to pay tax on this payment. ...

Amanda Amey

Jun 30, 20201 min read

Common Tax Deductions made by Individuals

1. Depreciation on Assets, costing $300 or less Salary and wage earners and rental property owners will generally be entitled to an...

Amanda Amey

Jun 30, 20202 min read

bottom of page